Are Employee Business Expenses Deductible For 2024 Medicare

Are Employee Business Expenses Deductible For 2024 Medicare – Social Security taxes are part of FICA taxes along with Medicare your business. Depending on where your business is located, your employees may be able to deduct certain job-related expenses . Whether you’re a business owner it even reaches the employee’s bank account. This portion is split into three categories to fund government programs: FICA taxes include both Social Security and .

Are Employee Business Expenses Deductible For 2024 Medicare

Source : taxfoundation.orgWhat Changes Are Coming to Medicare in 2024?

Source : www.aarp.orgThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comWhat Changes Are Coming to Medicare in 2024?

Source : www.aarp.orgThe 2024 Medicare Landscape | ThinkAdvisor

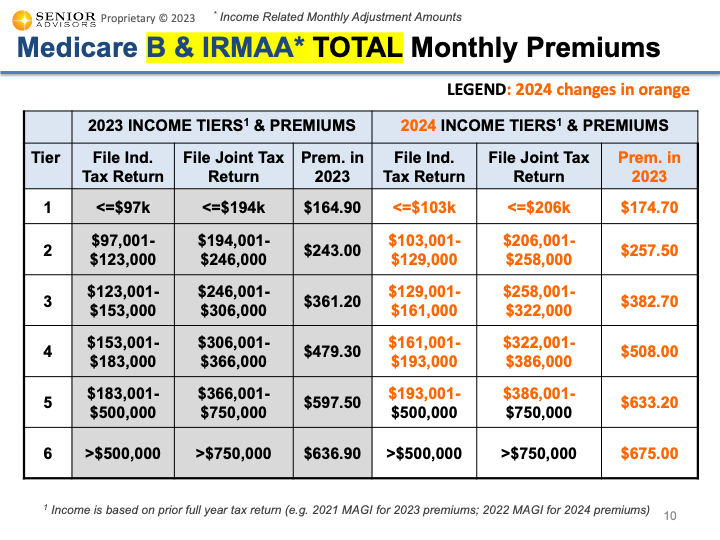

Source : www.thinkadvisor.comMedicare Blog: Moorestown, Cranford NJ

Source : www.senior-advisors.com7 Changes in 2024 That Impact Retirement Finances

Source : www.aarp.orgMedicare Part B Premium for 2024 Los Angeles City Employees

Source : www.lacers.org2024 Medicare Changes: What Insurance Agents Need to Know

Source : blog.newhorizonsmktg.comSupplement to J.K. Lasser’s Small Business Taxes 2024 Barbara

Source : bigideasforsmallbusiness.comAre Employee Business Expenses Deductible For 2024 Medicare 2024 State Business Tax Climate Index | Tax Foundation: Jane Haskins practiced law for 20 years, representing small businesses in startup, dissolution, business Medicare are federal programs that U.S. employees must pay into through employer . The biggest deductions for work expenses are restricted to self-employed people and small business owners Social Security and Medicare taxes that companies pay for employees. .

]]>